One of the most common questions that I’ve been asked (and one of the most popular debates that I’ve seen), is the question of whether it’s better to have a 30-year mortgage or a 15-year mortgage.

There are several versions of this question, such as:

- Should I pay down my mortgage early?

- Can I put additional money towards my mortgage each month?

- Is it better for me to prepay my mortgage?

- What type of mortgage is best for me (see: VA loans)?

There are many other ways to look at mortgages and their impact on your finances.

Table of Contents

15-Year vs. 30-Year Mortgage: What’s the Best?

Answer: It depends.

No, not really, and I’ll outline the difference in numbers below.

I wrote “it depends” because the best financial answer in any situation is the one that helps you sleep at night.

If paying off your mortgage gives you peace of mind, then you should continue to do so and disregard this article.

However, this article will break down the numbers and develop a recommendation.

If you’re still reading, then you’re interested in looking at the numbers, breaking down the difference between a 30-year mortgage and a 15-year mortgage, and seeing a recommendation.

Primary Difference Between 15-year and 30-year Mortgages

Before looking at examples, we need to address the major difference between these loan terms:

- A shorter loan term often means a lower interest rate, but higher monthly payments.

This means a 15-year mortgage will have higher monthly payments, but you will pay less interest over the loan duration.

The 30-year mortgage will often come with a slightly higher interest rate and lower monthly payments. Your monthly mortgage payment will be higher, and you will pay substantially more interest over the loan. But you may gain financial flexibility by locking in the lower monthly payment.

Case Study: Mortgage Facts

We’ll use a case study about a hypothetical military couple, Mr. and Mrs. Smith.

Mr. and Mrs. Smith have recently retired from active duty and have decided to buy a house in the Tampa area.

They’ve found the house they want and are going to buy it, either with cash they’ve saved, a 15-year mortgage, or a 30-year mortgage.

They want to know which decision is the best if they want to accumulate long-term wealth.

Let’s start with some facts, assumptions, and declarations.

- Home purchase: $250,000

- Proposed mortgage: $200,000

- 30-year mortgage rate (3.375% fixed rate with 0 points as of Aug. 5, 2016)

- 15-year mortgage rate (2.75% fixed rate with 0 points as of Aug. 5, 2016)

- Pension and salary: $100,000 per year

- Annual salary increases: 5% per year

- It’s hard to estimate salary increases. However, let’s assume they keep in line with inflation over the long run. This obviously doesn’t include bonus compensation, incentives or other types of compensation.

- Investment earnings: 7% per year

- According to historical data, since 1928, S&P 500 index’ geometric average (a more accurate means of calculating averages than the arithmetic approach) is 9.50%. Since 2006, the average is closer to 7%. Since the most recent numbers are more conservative, let’s use 7%.

- Savings rate: 10% of salary

- Why not? In a previous article, I’ve already outlined why you should pay yourself first, and discuss the reasons you should save at least 10% of your salary. Let’s stick with it.

- In addition to the 10% savings rate, the Smiths have budgeted for a 15-year mortgage, even though that’s a higher monthly payment. If their monthly payment is less than this amount, the Smiths have also committed to putting that difference into their investments. Below is what that will look like:

- 30-year option: Additional savings is the difference between the 15-year and 30-year mortgage payment.

- 15-year option: Additional savings is 0 for the first 15 years. Then the savings becomes the entire 15-year mortgage payment.

- Cash: Additional savings is the 15-year mortgage payment for the full 30-year period.

- Home price inflation: 5%

- According to the U.S. Census, National Association of Realtors, and the Case-Schiller Index, long-term housing price changes generally track with inflation rates over time. Real estate markets are subject to local conditions, but we will use the long-term inflation rate for this article. Since 1913, the average inflation rate has been around 3.2%, according to annual inflation data from the Federal Reserve Bank. We’ll round up and use 3.5%

Check your VA Home Loan eligibility and get personalized rates. Answer a few questions and we'll connect you with a trusted VA lender to answer any questions you have about the VA loan program.

Assumptions

- The Smiths stay in their house for 30 years.

- Job stability is constant. The Smiths may change their job(s), but their income is relatively stable, and rises consistently over time.

Declarations

This case study will not calculate the tax impact of mortgage interest.

Although there is a tax impact on home ownership, calculating that impact requires more detail than is provided in this case study.

There is no adverse tax impact from mortgage interest, and there may be a positive one if that causes your itemized deductions to exceed the standard deduction.

Since 30-year mortgages generally have more mortgage interest over their lifetimes (and certainly in the first 10 years), the scales would tip in the favor of a longer mortgage.

The tax benefit will not be factored in this case study.

Calculations are compounded on an annual basis.

Feel free to calculate monthly, but you’ll get a slightly more defined recommendation, not a different one.

Results

I’ll let the results speak for themselves below.

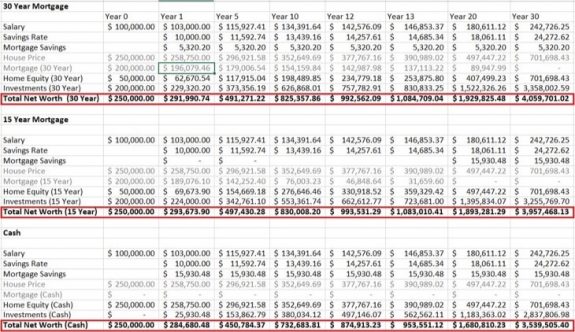

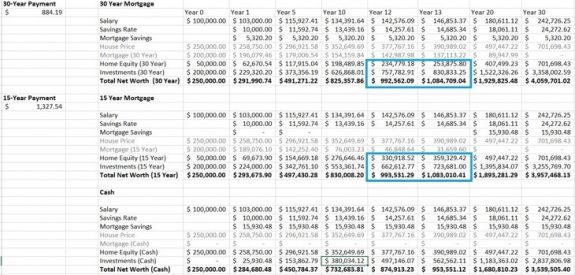

The numbers are a little difficult to read on a smaller image, so I’ll transfer the final net worth numbers after 30 years:

- 30-Year Mortgage – $4,059,701.02

- 15-Year Mortgage – $3,957,468.13

- Cash Buyer – $3,539,505.40

As you can see, the 30-year mortgage ends up creating the most overall value over time, when compared to the 15-year or cash options.

In fact, the 30-year mortgage created an additional $100,000 of wealth over the 30-year time frame compared to the 15-year mortgage and over $500,000 compared to the cash option.

There are a couple of observations that I’ll make. Then we’ll discuss why a longer mortgage creates a higher net worth.

Observations

No matter what, at the end of 30 years, the home equity is the same.

Having a mortgage has no bearing on how much your house is worth.

If your long-term goal is to stay in the same house, and you can make a 20% down payment, then you should be able to weather real estate market fluctuations.

Compounding interest is REAL power. (Learn More about the power of compound interest).

As you can see below, the 15-year mortgage plan starts off much stronger than the 30-year plan.

This is because the mortgage payment is paying down more principal at first. But then, something neat happens.

Between years 12 and 13, the 30-year mortgage surpasses the 15-year mortgage.

This is because the additional savings (the difference between the two mortgage payments that the Smiths decided to save) have increased their investment earnings over time.

Two years later, the 15-year mortgage is completely paid off, and the Smiths can plow the entire mortgage payment amount towards their investments.

However, the 15-year mortgage plan never catches up to the 30-year plan, which continues to pull away.

By the end of 30 years, it’s clear that the 30-year plan is continuing to distance itself from the other plans.

Now that the mortgage is paid off, there’s even more money to set aside for investments, meaning there’s no looking back.

If extrapolated to 40 years, this scenario ends up with the following numbers:

- 30-year plan: $8,205,141.32

- 15-year plan: $8,004,033.74

- Cash plan: $7,181,837.81

The all-cash plan is not competitive at any point.

The mortgaged plans start off with $200,000 in investments that take advantage of compounding interest from the very beginning.

Even though the all-cash plan can start putting money away instantly, it’s not competitive.

Until there is enough saved away to move the needle, the only real increase in value is related to the rise in house prices, which has a positive effect in all three situations.

Analysis

A couple of things to point out here:

People often argue about how much interest you pay over the life of a 30-year mortgage versus a 15-year mortgage.

That’s true. In this situation, the Smiths would pay almost $75,000 more in interest over the life of their $200,000 mortgage ($118,310 vs $44,303.94).

However, during that same 30 years, investment accounts under the 30-year plan ended up out-earning the 15-year plan by over $100,000, and the cash-only plan by over $500,000.

People argue that you’re paying ALL interest up front and only paying principal on the back end.

This is somewhat true but misunderstood.

When you calculate the annual interest you’re paying compared to the outstanding balance, you’ll find that the year-over-year interest rate is roughly in line.

However, each year, you are paying off some principal, which reduces the balance (thus the interest) for the next year. This keeps the annual interest rate at around the APR.

For example, at year one, you’re paying a total of $6,689.74 on an average outstanding balance of $197,887.31, which is roughly 3.8% (a more exact calculation would bring you closer to the 3.75% APR, but this is the best I can do in Excel).

At year five, you’re paying $6,123.91 on an average balance of $181,075, or 3.81 (again, Excel limitations), and so on.

By year 30, you’re paying $191.49 on an average balance of $4,805 (3.9%).

Over the long term, investing in equities has outpaced inflation and the cost of a mortgage.

This ability to generate a long-term return while borrowing at a lower rate produces wealth. That’s what banks do.

Does this mean you will always come out on top if you take a mortgage just to invest in the stock market? No.

If taken out of context, there are exceptions to just about any rule. For example:

- You’re running a credit risk if you over-leverage your house just to invest.

- You might encounter market risk if you immediately need to liquidate your long-term investments.

- Any time you own a home, you incur liquidity risk.

This is just an illustration.

The numbers work in this example.

And they will work in many similar case studies that look at past returns, especially when using fixed rates for stock market returns, inflation and salaries.

The future is much less predictable.

A VA loan could beat these rates.

Typically, if you’re a service member, spouse of a military member or veteran, or have previously served, you may be eligible for a VA loan, which typically has much lower rates than the standard mortgage.

Conclusion

Does this mean that a 30-year mortgage is always the right choice? No.

I know many people who would rather just not have a mortgage. They don’t care about the numbers.

They care about going to bed, knowing their house is paid for. They may be candidates for a 15-year mortgage or paying their mortgage off early.

That goes back to my original point: The best financial answer is the one that helps you sleep at night.

About the comments on this site:

These responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all posts and/or questions are answered.