Many people wonder what TSP’s Lifecycle funds (or L-funds) are, what they are supposed to do, and how they are supposed to invest in them. This article aims to answer some of these questions and provide a little clarity. When used properly, the Thrift Savings Plan Lifecycle Funds can help investors maintain a balanced asset allocation. Let’s jump in and learn more.

Table of Contents

- Thrift Savings Plan Overview:

- Watch this video for a quick Lifecycle Fund primer!

- Lifecycle funds overview:

- Lifecycle Fund Asset Allocation

- Who Picks the Funds?

- What is the Efficient Frontier?

- Pros and Cons of Using Target Date Retirement Funds

- What happens when you start tinkering with other funds…you miss the point of having a Lifecycle Fund

- Should you invest with Target Date Retirement Funds?

Thrift Savings Plan Overview:

To understand more about TSP’s Lifecycle Funds, it’s best to understand a little more about TSP’s primary funds. There are 5 primary mutual funds in the Thrift Savings Plan:

- G-Fund: Comprised of U.S. Treasuries

- F-Fund: Index fund comprised of investment-grade U.S. corporate debt. It aims to track the Barclays Capital U.S. Aggregate Bond Index.

- C-Fund: Index fund comprised of stocks from the top 500 U.S. Companies. It aims to track the S&P 500 Index.

- S-Fund: Index fund comprised of stocks from U.S. companies not in the S&P 500. It aims to track the Dow Jones U.S. Completion Total Stock Market Index.

- I-Fund: Index fund comprised of stocks from international companies. It aims to track the MSCI Europe, Australasia, & Far East (EAFE) Index.

There is a lot of information out there about TSP funds. However, one important thing to understand is how diversification plays a role in building a solid portfolio. Once you understand how TSP funds work, you can understand how Lifecycle funds work.

Watch this video for a quick Lifecycle Fund primer!

Lifecycle funds overview:

TSP’s Lifecycle funds are simply target-date funds that consist of different combinations of its G, F, C, S, & I Funds. A target-date fund is simply a fund that initially invests in growth assets. Over time, this fund gradually shifts to more conservative investments until it reaches a predetermined date.

For example, the L 2020 fund will gradually adjust its investment mix until 2020. At this point, it will shift to the L-Income fund. The L-Income fund is the most conservative of the L-funds and most heavily invested in U.S. Treasuries. Currently, the Thrift Savings Plan provides the following funds (in order from most conservative to least): L-Income, L2020, L2030, L2040, and L2050.

Let’s compare the two extremes: L-Income & L2050. As its name indicates, L-Income is the fund of choice for people in retirement (actual retirement, not retiring from the military), who depend on a safe, predictable income from stable investments. Conversely, the L2050 fund is for people who don’t expect to use those investments until 2050 or beyond.

As you would expect, L-Income contains a lot more of its investments in the G-fund than L2050, which has most of its investments in C, S, & I funds. The other funds fall somewhere in between but vary based upon the investment horizon. The current breakdown (as of January 2019) is below but can be found on the TSP Lifecycle Fund information page (rounded to the nearest whole number).

| L-Income | 2020 | 2030 | 2040 | 2050 | |

|---|---|---|---|---|---|

| G | 74% | 64 | 33 | 21 | 11 |

| F | 5 | 6 | 7 | 7 | 7 |

| C | 11 | 15 | 30 | 36 | 40 |

| S | 3 | 4 | 9 | 11 | 13 |

| I | 7 | 10 | 21 | 25 | 29 |

As you can see, G & F funds (both bonds), make up almost 80% of L-Income, but only 14% of L2050. This allows L-Income to provide consistent income with a less risky portfolio. Conversely, stocks make up just 20% of L-Income, but 85% of L2050, which positions L2050 for long-term growth.

Lifecycle Fund Asset Allocation

Now that we know a little about Lifecycle Funds, let’s talk about asset allocation. Asset allocation is simply the process of taking a certain number of investments (in this case, the five TSP funds), and figuring out how much of your money to put into each. It’s a decision everyone must make, whether you want to or not.

Many people decide to perform their own asset allocation and choose which investments to put their money in. For TSP’s Lifecycle Funds, asset allocation is done based upon investment modeling by Mercer Investment Consulting, one of the world’s largest investment consulting firms. By choosing a Lifecycle fund, you are making a decision based on an analysis performed by a professional consultant.

Who Picks the Funds?

Mercer Investment Consulting does, and they’re good at it.

Learning a little about that might be worthwhile if you’re trusting a decision based on a consultant’s work. According to Wikipedia, Mercer Investment Consulting is the world’s largest HR consulting firm. It has been around since 1937, when it started as the employee benefits department at Marsh & McLennan, Inc., the company still owns it. One of Mercer’s primary business lines is performing worldwide consulting work with companies & governments who administer retirement plans like TSP. Let’s assume the folks at Mercer Investment Consulting know what they’re doing without going into more detail.

What is the Efficient Frontier?

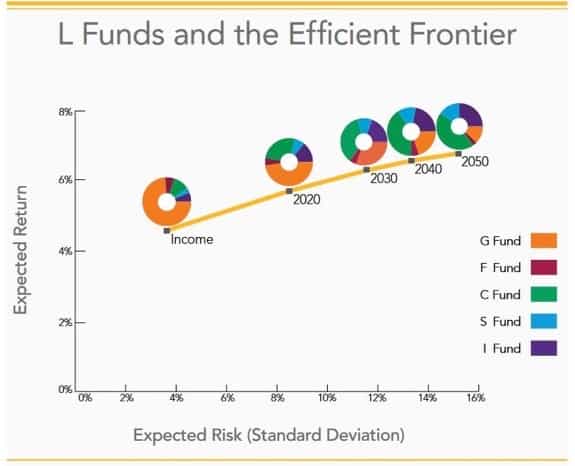

Now that we’ve established who makes the decisions on your L-funds, we should look a little more into how they make those decisions. The TSP fact sheet does a really good job of explaining the ‘efficient frontier,’ which is the basis of the L-fund asset allocation. Simply put, there is a risk/return relationship between any investment or any combination of investments. The risk is measured in standard deviation, while the return is measured in annual percentage return—you can plot any investment on a graph that reflects these two measures.

The efficient frontier is a theory that all of the best possible investment combinations are plotted on a line from least to most risky. This line is known as the efficient frontier. The Lifecycle Funds information page does a great job explaining this with a graph on Page 2.

In this case, we’re using TSP funds (and combinations of them), without respect to any other mutual fund, stock, or other securities. Any investment that is above the efficient frontier line is not attainable. For example, 0% standard deviation and 30% expected annual return is not attainable.

However, any investment below the line is less than what you should expect. For example, 2% return at 5% standard deviation. As you can see, L-Income is much further to the left (indicating lower risk & lower expected return) than any of the target-date funds. As we get closer to the maturity of a target-date fund, you can expect that fund to slide further to the left and approach the L-Income fund.

Pros and Cons of Using Target Date Retirement Funds

Pros

- Hands-off investment strategy. Since target-date retirement funds are set up to adjust the allocation of investments automatically, there is little effort needed on the part of the investor once the fund has been established. This may appeal to investors who do not have the time or confidence needed to actively manage their portfolio.

- Little to no maintenance. Due to the very nature of a target-date retirement fund, there is little, if any, maintenance required by the investor.

- Minimum investment requirements. This allows for a broader allocation to include various asset classes.

Cons

- There is no such thing as one-size-fits-all. You understand this concept when you buy clothing, and you should certainly consider this when selecting an investment strategy. Each person is different, with varying risk tolerance and financial goals. Unfortunately, the very thing that makes target-date retirement funds hassle-free also requires that the strategy treat each portfolio the same way. This may result in an investment strategy that does not reflect your unique situation.

- Higher fees. Expect to pay slightly higher fees for this type of investment than you might for other investment vehicles.

What happens when you start tinkering with other funds…you miss the point of having a Lifecycle Fund

Now we get to the point. When you invest in TSP’s Lifecycle Funds, you are:

- Deciding as to when you need this money

- Trusting the Mercer Investment Consulting asset allocation model

If you ‘set it & forget it,’ then you’re investing on the efficient frontier (or at least Mercer’s definition). Not only that, but the L-fund automatically adjusts over time to lower the portfolio risk. If you invest in an L-fund, then put a bunch of money in one of the other funds, you’ll probably screw up the asset allocation. This means you’ll either be taking too much risk for the return you expect to make, or you won’t be making as much money as you should expect for the risk you’re taking…you’re under the line. You’ll need to make regular adjustments to ensure your portfolio is properly balanced, which you don’t need to do with an L-fund.

You might have money in other accounts that you cannot put into TSP. There is nothing wrong with that. However, you should recognize that outside investments may alter your asset allocation within TSP. Sitting down with a fee-only financial planner ensures that your asset allocation meets your investment goals.

Should you invest with Target Date Retirement Funds?

Life-cycle funds aren’t for everybody, but they are a great place to start for people who don’t know where to start investing, it can also be an investment strategy that appeals to individuals who prefer not to have to deal with managing their portfolio. Nevertheless, “hand’s off” doesn’t equal risk-free.

As with any other type of investment, there is always the chance the strategy will not work out as intended. When buying into a target date fund or life-cycle fund, you should research to fully understand where and how your money is invested and how it affects your asset allocation.

Comments:

About the comments on this site:

These responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all posts and/or questions are answered.

David A. Jones says

Either Forrest Baumhover cannot add or I cannot read. The graphic totals don’t add up under the heading ‘Lifecycle Funds Overview.”